Nearshoring Trends: Regional OEM/ODM Strategies for Cabinet Factories

Discover how nearshoring is reshaping cabinet factory strategies through regionalized OEM/ODM models. Explore case studies from Mexico, Eastern Europe, and AI-driven smart factories, highlighting trends in sustainable manufacturing, supply chain resilience, and tech innovation.

- 1. Geopolitical Shifts and Supply Chain Resilience Fuel Nearshoring Surge

- 2. Mexican Case Study: From Contract Manufacturing to Smart Factories

- 3. Eastern European Benchmark: Germany’s Industry 4.0 “Dream Factory” for Cabinets

- 4. Tech-Enabled Regional Strategies: AI and Sustainable Manufacturing

- 5. Balancing Risks and Opportunities: The Future of Nearshoring

1. Geopolitical Shifts and Supply Chain Resilience Fuel Nearshoring Surge

Heightened geopolitical tensions and post-pandemic supply chain vulnerabilities have accelerated nearshoring as a strategic priority for cabinet manufacturers. The U.S. CHIPS Act’s ripple effect has pushed North American manufacturing reshoring, with Mexico emerging as the top destination for U.S.-bound cabinet OEM orders due to 30-40% lower labor costs than China and 3-5 day proximity to U.S. borders. BCG forecasts Mexican exports to the U.S. will surpass China by 2025, capturing 35% of the North American market. Meanwhile, Eastern European nations like Poland and Czechia leverage EU single-market access and German Industry 4.0 expertise to handle Western Europe’s high-end cabinet ODM design orders, growing at 28% annually.

2. Mexican Case Study: From Contract Manufacturing to Smart Factories

- Marge Carson: Operating in Tijuana for 25 years, 95% of its products are made locally. Its SAP ERP system synchronizes U.S.-Mexico tariffs, maximizing cost efficiency. CEO Jim LaBarge notes: “Mexico’s supply chain resilience outperforms Asia’s, but investing in precision equipment is critical to meet capacity demands.”

- Sunon Group: Launched its Monterrey, Mexico factory in 2023, deploying Oracle NetSuite cloud ERP for cross-border finance and tax integration. The digital deployment was completed in 100 days, and its intelligent TMS logistics system enables dynamic inventory allocation across China, the U.S., and Mexico, reducing order delivery cycles by 40%.

- Challenge Resolution: A-America overcame truck driver shortages (80,000 gaps in the U.S.) in Mexico by adopting “multimodal transport + regional distribution hubs,” cutting logistics costs by 15%.

3. Eastern European Benchmark: Germany’s Industry 4.0 “Dream Factory” for Cabinets

Germany’s Nobilia Bielefeld plant—the world’s largest cabinet production facility—churns out 3,500 units daily. Powered by digital twin technology, it automates end-to-end processes from scheduling to packaging. Key innovations include:

- AI Visual Inspection: Edge sealing accuracy ≤0.5mm, defect rate reduced to 0.3%;

- Smart Warehousing: 166-truck docking zone enables “dark factory” logistics, boosting inventory turnover by 50%;

- Green Transformation: Water-based paint lines cut VOCs emissions by 90%, earning EU environmental certification.

4. Tech-Enabled Regional Strategies: AI and Sustainable Manufacturing

- Smart Factories: OPPEIN’s proprietary AI system integrates MTDS (Manufacturing Data System) and WCC (Workflow Control Center), using deep learning to optimize scheduling and cutting non-standard custom order design cycles to 48 hours.

- Green Materials: Nantong Hai’an Furniture Park’s “shared spraying center” deploys water-based paint automation, reducing SME pollution control costs by 40%.

- Regional Synergy: Polish factories combine EU geographical advantages with Italian design resources (e.g., Milan) to create integrated “design-production-logistics” chains, accelerating response times by 30%.

5. Balancing Risks and Opportunities: The Future of Nearshoring

While nearshoring enhances supply chain efficiency, firms must mitigate labor shortages (e.g., Mexican truck drivers), policy volatility (EU carbon tariffs), and technical barriers (Germany’s Industry 4.0 standards). The future will likely see a hybrid outsourcing model (nearshore + offshore), requiring firms to deploy digital platforms (e.g., Oracle NetSuite) for global resource allocation and invest in green tech (e.g., biodegradable panels) to align with global carbon neutrality trends.

How to Make Traditional Kitchen Cabinets Look Modern

12 Reasons Why Custom Solid Wood Kitchen Cabinets Are the Only Investment That Truly Adds Value to Your Home

How to Maximize Storage Space with Kitchen Cabinet Inserts

What to Add to a Luxury Wardrobe Closet?

FAQ

What information are needed for getting a quote for our furniture cabinets?

Your size infomation or room drawings.

What's the payment terms of all our products?

T/T (30% inadvance, the balance shall be paid off before delivery), Western Union or L/C.

What's lead time for furniture cabinets?

It's about 20 - 30 days.

Can we produce products according to customer's room size?

Yes. All our cabinets are custom size.

What's MOQ for our kitchen cabinets, wardrobe cabinets or bathroom cabinets?

1 set.

Premium Melamine Carcass Bathroom Vanity with Quartz Countertop | Foshan Murano Custom Solutions

T-shaped invisible door MA10

Flush panel door MA11

Siyun double wooden door MA12A

External flush right inward opening door MA13

Aluminum Frame Glass Hinged Door - MBB001

Aluminum Frame Glass Hinged Door - MBB003

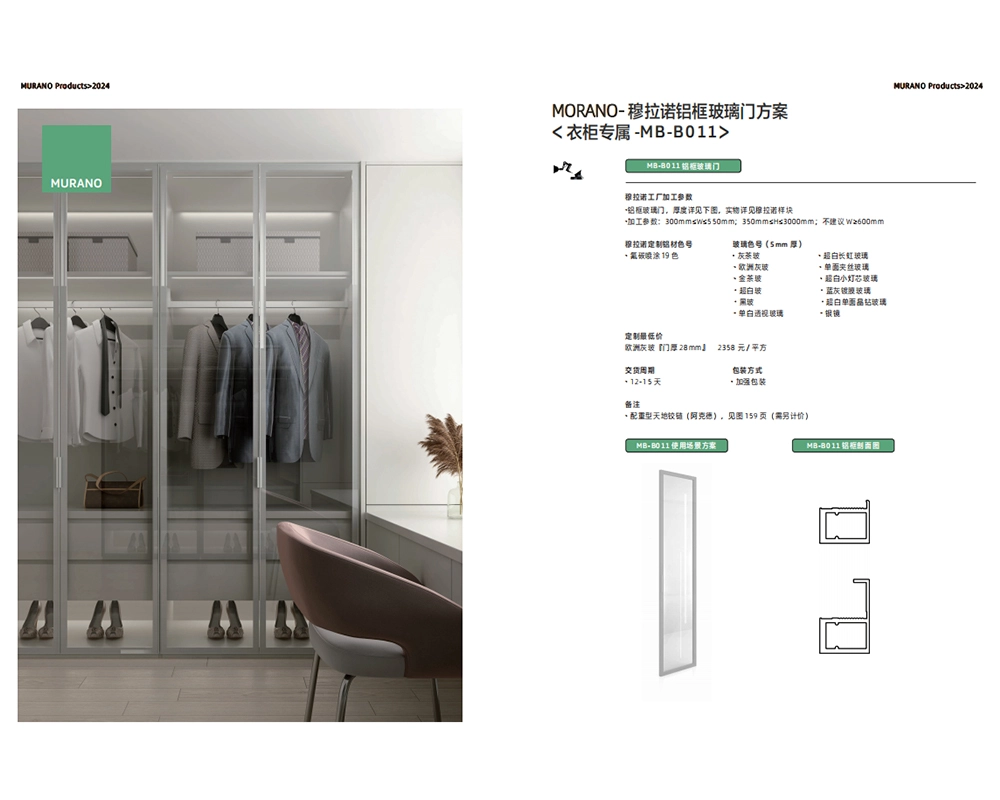

Aluminum Frame Glass Hinged Door - MBB011

Request a Free Consultation And Price Estimate

Get in touch with Murano today for a personalized consultation, and let us bring your vision to life. Fill out the form below or contact Murano directly to start your journey toward a beautifully tailored home!"

Scan QR Code

Scan QR Code

FoshanMuranoCabinet

foshanmuranocabinet

Whatsapp: +8618814138020

Scan QR Code