Sustainable Material Innovation in Global Cabinet Manufacturing—Eco-Strategies and Shifting Consumer Preferences

Discover how global cabinet manufacturers are adopting eco-friendly materials like bamboo, recycled plastics, and FSC-certified wood to meet 78% of consumers' willingness to pay premium prices for sustainable cabinets.

- Market Shifts: Sustainability as a Consumer Imperative

- Case Studies: Pioneering Sustainable Manufacturing

- Technological Synergies: Smart Factories Meet Green Materials

- Consumer Trends: Design and Functionality Evolution

- Challenges and Adaptive Strategies

- Future Outlook: Circularity and Digitalization

Market Shifts: Sustainability as a Consumer Imperative

The 2025 global cabinet market is projected to reach $236.01 billion, driven by a 7.4% CAGR fueled by eco-conscious demand. Consumer surveys reveal 45% of buyers prioritize sustainable materials, with 30% willing to pay 20-30% premiums for personalized eco-friendly finishes. This shift is reshaping manufacturing strategies:

- Europe leads with 35% market share for FSC-certified wood/recycled plastic cabinets (e.g., Germany’s Schinning uses 100% recycled PET in edge banding).

- China’s TUBAO Super E0 Board (<0.03mg/m³ formaldehyde) dominates second-tier cities, reflecting Asia-Pacific’s 48% residential application dominance.

Case Studies: Pioneering Sustainable Manufacturing

IKEA’s KUNGSBACKA Series

Sweden’s IKEA pioneers circularity by repurposing 20 million PET bottles annually into cabinet doors, reducing virgin plastic use by 40%. This aligns with 68% of Nordic consumers demanding recyclable packaging.

Puustelli Miinus: Carbon-Negative Cabinets

Finland’s Puustelli achieves carbon negativity through patented wood-fiber composites and solar-powered factories. Their Miinus line reduces lifecycle emissions by 70% compared to conventional cabinets.

Smith & Vallee’s Reclaimed Wood Collection

US-based Smith & Vallee transforms salvaged barn wood into luxury cabinets, commanding 30% premiums in high-end markets. This approach reduces landfill waste by 500 tons annually.

Technological Synergies: Smart Factories Meet Green Materials

Digital transformation enhances sustainable production:

- AI Material Optimization

China’s QuanU employs HPO software to batch-process FSC-certified panels, boosting material utilization by 15% while maintaining 0.1mm cutting precision. - Blockchain Traceability

Germany’s Schinning integrates blockchain to track bamboo sourcing from Vietnam to EU markets, ensuring compliance with EUDR regulations.

Consumer Trends: Design and Functionality Evolution

Deep Tones & Matte Finishes

Navy blue and forest green cabinets (30% YOY growth) paired with matte finishes dominate luxury markets. Textured 3D cabinetry (e.g., fluted doors) appeals to 42% of mid-century modern enthusiasts.

Smart Integration

Asia-Pacific markets prioritize auto-sensing lighting (65% adoption in Chinese smart kitchens) and waste management systems, while North America favors modular systems (30% market share) for DIY flexibility.

Challenges and Adaptive Strategies

Raw Material Volatility

Tariffs on imported yarns/dyes and labor cost surges pressure manufacturers. Solutions include:

- Localized Production: Dura Supreme’s North Carolina factory circumvents U.S. CVD tariffs.

- Alternative Materials: Bamboo (20% cheaper than oak) and hemp fiber composites gain traction.

Regulatory Compliance

EU’s CPR and California’s CARB-2 mandate low-VOC finishes, pushing 80% of manufacturers to adopt water-based coatings.

Future Outlook: Circularity and Digitalization

By 2030, circular business models will dominate:

- Take-Back Programs: 40% of brands will offer cabinet recycling/refurbishment.

- AI-Driven Design: 3D virtual platforms will enable 95% accuracy in WYSIWYG customization, reducing returns by 25%.

- Biodegradable Composites: Mushroom mycelium and algae-based materials will enter mainstream production.

How to Make Traditional Kitchen Cabinets Look Modern

How to Maximize Storage Space with Kitchen Cabinet Inserts

What to Add to a Luxury Wardrobe Closet?

How to Design Functional Kitchen and Joinery for Small Spaces?

FAQ

What's the payment terms of all our products?

T/T (30% inadvance, the balance shall be paid off before delivery), Western Union or L/C.

Can we produce products according to customer's room size?

Yes. All our cabinets are custom size.

What information are needed for getting a quote for our furniture cabinets?

Your size infomation or room drawings.

What's MOQ for our kitchen cabinets, wardrobe cabinets or bathroom cabinets?

1 set.

Can we ship the furniture cabinets to customer's port or city?

Yes. Please provide the city name or port name when you send us an inquiry.

T-shaped invisible door MA10

Flush panel door MA11

Siyun double wooden door MA12A

External flush right inward opening door MA13

Aluminum Frame Glass Hinged Door - MBB001

Aluminum Frame Glass Hinged Door - MBB003

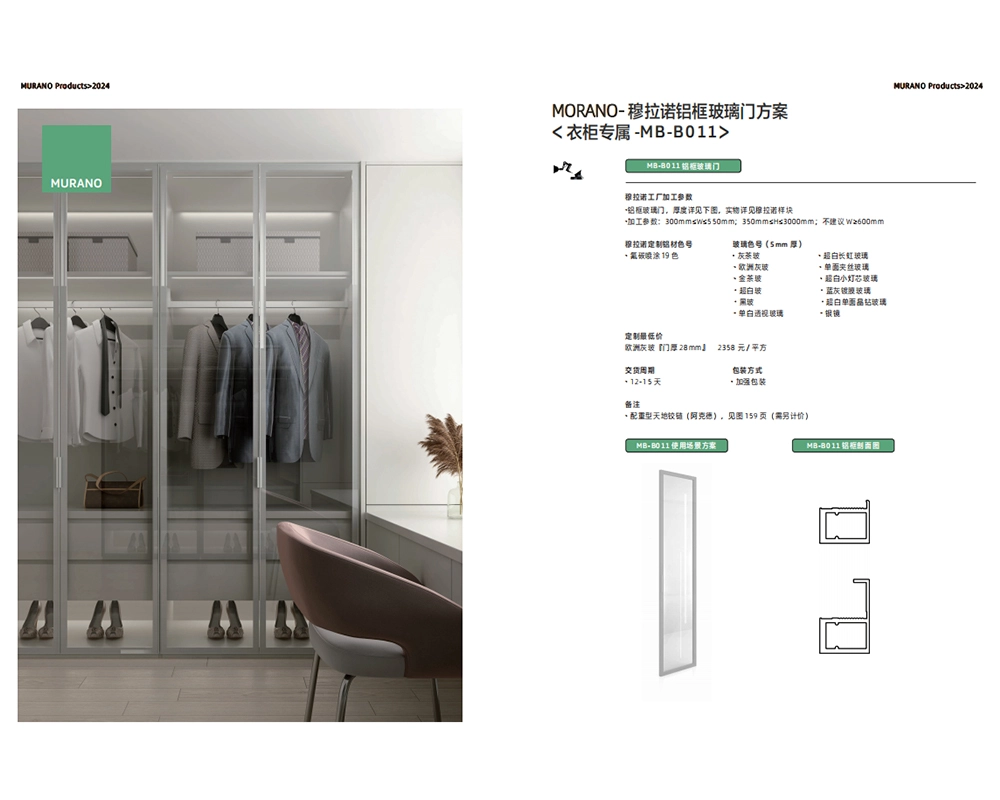

Aluminum Frame Glass Hinged Door - MBB011

SZ Single side glass interior door

Request a Free Consultation And Price Estimate

Get in touch with Murano today for a personalized consultation, and let us bring your vision to life. Fill out the form below or contact Murano directly to start your journey toward a beautifully tailored home!"

Scan QR Code

Scan QR Code

FoshanMuranoCabinet

foshanmuranocabinet

Whatsapp: +8618814138020

Scan QR Code